Who is John Galt?

What is a family wealth investor going to do in this environment?

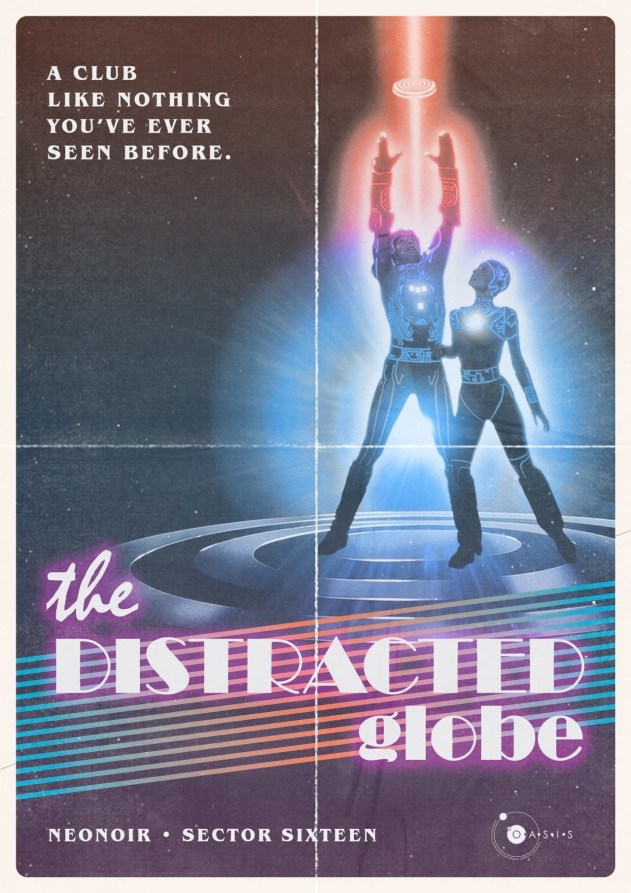

How cool is this Sci-Fi plot?

In the year 2044, the world is gripped by an energy crisis and global warming, causing widespread social problems and economic stagnation.

The primary escape for most people is a virtual universe called the OASIS, which is accessed with a visor and haptic gloves.

It functions both as an online role-playing game and a virtual society, with its currency being the most stable currency in the world.

It was created by James Halliday, who has recently died. His will left a series of clues towards an Easter Egg within the OASIS that would grant whoever found it both his fortune and control of the OASIS itself.

This has led to an intense interest in all aspects of 80s pop culture, which Halliday made clear would be essential to finding his egg.

From Wikipedia on the book and soon to be Stephen Spielberg movie – Ready Player One

Oscar Wild was famous for saying that “Life imitates Art far more than Art imitates Life”

Let’s take stock …

Over the last month the markets have oscillated violently within a narrow range as they digest:

- Civil unrest and shootings in numerous US cities.

- A seemingly insane general election – to put it mildly.

- A Federal Reserve jaw boning raising interest rates but gun shy when it comes to pulling the trigger.

- Europe’s 4thlargest bank and counterparty to 55.6 trillion euros of Notional derivative exposure experiencing significant capital problems;

- And nature throwing down with a Category 4 Hurricane.

In a masterful sleight of hand the common denominator here (except possibly for the weather) is a monetary experiment dreamed up in a Science Fiction novel.

The suppression of interest rates (for over eight years now) in an effort to boost economic growth seems only to have increased wealth inequality, bred social discord and given rise to a populist candidate nobody likes yet half the country polls positively for.

It’s the Economy Stupid!

Here’s a question we cannot seem to get an adequate answer for:

Consider that Russian Central Planning aka. Communism is generally considered to be a colossal failure.

So we wonder, why it is that Central Bank planning is destined to be wonderfully successfully and the panacea for the world economy?

How can bureaucrats manage better than the free market?

They can’t!

And it’s time to face the fact that America’s $19 trillion dollars in debt is unpayable

Fundamentals remains poor.

US Corporate profits peaked in the 4th Quarter of 2014 and are now nearly 10% below that peak.

All the while, equity markets have risen or stagnated!

We contend that monetary policy is responsible for keeping stock prices high while underlying business conditions have deteriorated with most companies favoring debt-funded stock-buybacks over capital investment.

As CPI continues to creep surprisingly higher the Fed will ultimately be compelled to raise rates with potentially bad outcomes.

What is a family wealth investor to do?

Our playbook is to remain totally disciplined to our buy and sell disciplines.

Try to stay mindful of (y)our own mental pitfalls — hopefully they will be useful in avoiding a few land mines!

Antidote to mental pitfalls

- Simplify problems

- Find numerical support

- Invert always invert: look at downside, look for disconfirming evidence, kill the idea

- Multi-disciplinary approach (fundamental, technical, sentiment)

- Properly consider result from a combination of factors: loolapalooza effect

- Be skeptical, always ask why and do your home work

- Keep a written investment diary; very effective method of learning from mistakes

- Be flexible, focus on facts, when they change, change your mind

- Pre-commitment wishing list or inventory idea

- Use of autopsy: post mortem reverse engineering

- Focus on process not outcome: what buying, what price, what sizing and what selling

- Don’t model: THINK!! Be independent, do your judgement through your experience

- Be patient: never underestimate the value of doing nothing

- Implement the checklist a simple one

- You must know your limits, your circle of competence: distinguish what you know and what you don’t know. Be humble about what you don’t know

These are deceptively dangerous times for family wealth in financial markets … look before you leap!

Best

Greg

—

Thank you for reading my post. Please sign up for our newsletter which contains private investment opportunities and other great information.

Nothing in this article should be interpreted as a recommendation to buy any security. Please consult your financial advisor & conduct your own due diligence.